Initially, Umpqua Bank was opened as South Umpqua State Bank in 1953 and then eventually went via a new name. It has roots in the timber town of Canyonville, Oregon, located beside the South Umpqua River.

It expanded further from Oregon into Washington, California, Nevada. In this article, we are going to discuss the Umpqua Routing Number, its uses and the difference between routing number and swift codes.

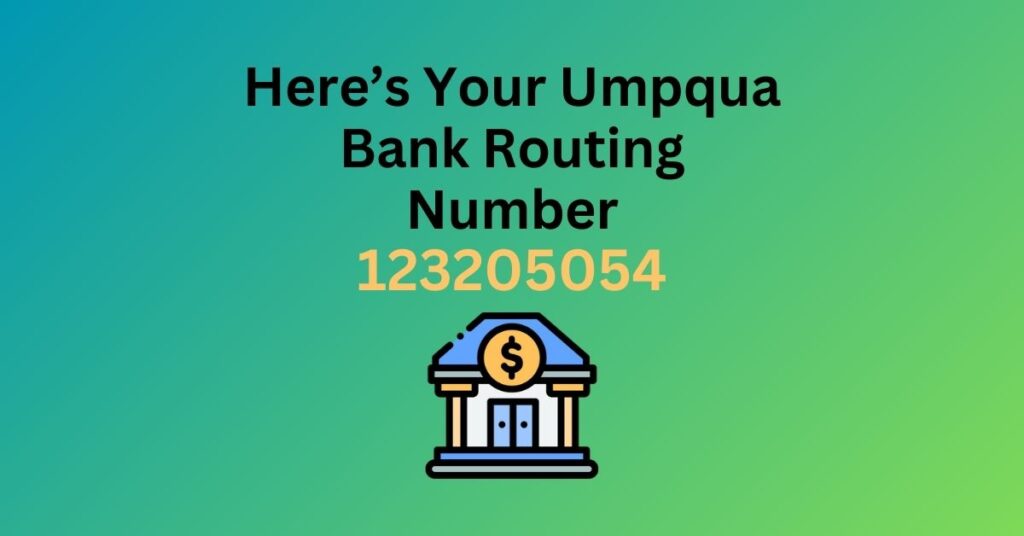

Umpqua Routing Number

Here’s Umpqua’s routing number; 123205054; You’ll use this number to set up wire transfers, order checks and make direct deposits using your Umpqua account.

What Is a Routing Number?

Banks use routing numbers to identify each other. The Routing numbers consist of 9 digits that contain details which show the identity of financial institutions behind the banking transactions.

The American Bankers Association was the first to introduce the routing number in 1910, to recognize check processing end points. But at present times, Routing numbers perform various functions, it is also used to set up new digital payments.

The most used routing numbers are the ABA routing numbers, which are used to pay recurring bills, reorder checks, tax refunds and in general every transaction between financial institutions. Within these numbers that are especially used for digital transactions are called ACH (Automated Clearing House). Don’t miss out! Check our previously published article on Your Webster Bank Routing Number.

Can Banks Have Multiple Routing Numbers?

Yes, usually big banks can use many routing numbers. Banks like Wells Fargo and Citibank use multiple routing numbers for different states and to show old mergers. But Umpqua Bank, being on the smaller side, only uses one routing number, regardless of where you opened the account.

Where can we search a Routing Number on a Check?

Usually, Routing numbers are located on the left side of the bottom corner of a check along with the account number. We can observe that these routing numbers are written in short font. This is because checks use a special type of font and toner called MICR (magnetic ink character recognition code).This enables machines to read checks.

Find a routing number without a check

If you don’t readily have a check from your bank, you can find a routing number by doing one of the following: -Locate it in your bank statement -Calling your bank and request their routing number -Online lookup in your bank’s website

What Is the Routing Number for International Transfers?

When you transfer funds to another country, you have to use the bank’s SWIFT codes. Umpqua Bank’s SWIFT code is as follows:

Umpqua SWIFT Code– UMPQUS6P

To search the Umpqua Bank routing number online

You can search for your Umpqua Bank routing number online, here are some ways given:

1. Umpqua Bank online banking: Open your Umpqua online banking app to check your routing number by signing into your respective account.

2. Fedwire: You can find your routing number via the official Fedwire website.

Which Umpqua Bank routing number should you use?

The Umpqua Bank routing number you should use depends on the state in which you opened your account and the type of transaction. Routing number of each state is different from another.

Routing numbers, SWIFT codes, BIC and IBANs – what’s the difference?

You have to gain some knowledge to send or receive a wire transfer. Routing numbers help identify banks when processing domestic ACH payments or wire transfers. But only in the United States. You don’t need one to make a payment to your friend in France, for example.

SWIFT codes are also used to recognize banks and financial institutions. But for international transactions. They’re also called BIC codes, which stands for Bank Identification Codes.

IBANs stand for international bank account numbers, recognize separate bank accounts. They’re issued by many banks in Europe, but banks elsewhere in the world are starting to adopt them as well. Have you seen it yet? Check our previously published article on How To Open a U.S. Bank Account.

Frequently Asked Questions

The routing number is made up of a nine digit number given to each bank to recognize itself, on the other hand, the account number is used to recognize a unique bank account of the people. To do a money transfer, you’ll need both.

Routing numbers don’t appear on credit or debit cards. Occasionally, routing numbers are confused or mixed up with account numbers, which do appear on cards.

The main difference is that an ABA number is used for check or paper transfers, while an ACH number is used for electronic money transfers. Although technically ACH numbers are ABA numbers and typically, they’re the same, it’s important to verify that they are correct depending on the type of transfer you want to make.

The key differences between an ACH transfer and a wire transfer are speed and cost. Although a money transfer with the ACH network is usually free or very low cost, it may take up to three days to reach its destination.

A wire transfer, both domestically and for international money transfers, usually happens the same day or sometimes instantly, though it comes with fees that might go up to $50.

Conclusion

To summarize the entire discussion, we can say that the routing number is important for wire transfer and money transfer along with the account number. Without these numbers we can’t process our transaction. As we know that routing number is used to identify the bank domestically but the SWIFT code is used to identify the branch of the bank internationally.

Also, the routing number of each state is different and it depends on the region where we have opened our bank account. Have a look at: Axos Bank Routing Number. It is very important to know your bank’s routing number.