Here is a step-by-step guide to easily apply for a credit card in the Nedbank.

In Short

- The minimum age to apply for the Nedbank credit card should be at least 18 years.

- The maximum age to Nedbank apply for a credit card should not be more than 60 years.

- The credit score of the applicant must be decent to avail of a Nedbank credit card.

With the improvement in technology, applying for a credit card has become simpler and easier. Nedbank offers various rewards for transactions done via credit card. Through Nedbank, you can effortlessly apply for a Nedbank Credit Card with the official website, www.nedbank.co.za.

How to choose a Nedbank credit card?

To find the Nedbank credit card for this list, we evaluated each card based on its fees, rewards, welcome bonuses, introductory offers, features, and benefits. Read our previously published article on Can I check Nedbank Credit Card Application Status?

- New Nedbank Gold Credit Card

- Nedbank Platinum Credit Card

- The American Express Gold Credit Card

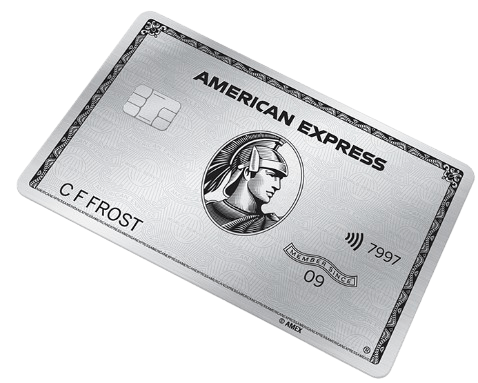

- The American Express Platinum Credit Card

- SAA Voyager Gold Credit Card

- SAA Voyager Premium Credit Card

New Nedbank Gold Credit Card

Rates & fees

- R20 monthly service fee.

- Credit facility fee from R20 a month.

- R27 optional Greenbacks linkage fee.

- Zero charges on card swipes.

Requirements

- Monthly income required R5,000 p/m

- Age must be 18 years or older

- Valid South African ID book or Smart card, proof of residence, and the latest proof of income for three consecutive months

Features and Benefits

- Get up to 55 days interest-free on qualifying transactions

- Get an affordable credit solution

- Optional credit life cover in case you die, become disabled, contract a critical illness, or get retrenched.

- Optional top-up travel insurance is available.

- Get real-time SMSs for transactions.

- Use your card to pay and get 50% off your Nu Metro movie tickets.

- Get 25c cash back for every liter of fuel when you fill up at BP with your Greenbacks-linked card.

Nedbank Platinum Credit Card

Requirements

- Monthly income required R29,000p/m

- Age must be 18 years or older

- Valid South African ID book or Smart card, proof of residence, and the latest proof of income for three consecutive months

Features and Benefits

- Get up to 55 days interest-free on qualifying transactions

- Use your card to pay and get 50% off your Nu Metro movie tickets.

- Get 25c cash back for every liter of fuel when you fill up at BP with your Greenbacks-linked card.

- Get travel insurance up to R3 million.

- Get real-time SMSs for transactions.

The American Express Gold Credit Card

Rates & fees

- R124p/m monthly service fee.

- R124 monthly service fee.

- R180 once-off initiation fee.

- R21 a month credit facility fee.

- Free lost card replacement. R450 for same-day delivery.

- Interest rate: From 21.40% to 22.25%

Requirements

- Monthly income required R17,000 p/m

- Age must be 18 years or older

- Valid South African ID book or Smart card, proof of residence, and the latest proof of income for three consecutive months

Features and Benefits

- Get up to 55 days interest-free on qualifying transactions

- Enjoy access to domestic airport lounges

- Use your card to pay and get 50% off your Nu Metro movie tickets.

- Earn 1 Membership Rewards point for every R5 eligible* spend. There is no limit on points you can earn and they never expire.

- Get travel insurance of up to R4 million.

- Flexible repayment options.

The American Express Platinum Credit Card

Requirements

- Monthly income required R62,500p/m

- Age must be 18 years or older

- Valid South African ID book or Smart card, proof of residence, and the latest proof of income for three consecutive months

Features and Benefits

- Get up to 55 days interest-free on qualifying transactions

- Earn 30,000 Membership Rewards points when you get approved for the Card and spend R10,000 in the first 3 months.

- Enjoy exclusive access to the Amex for Foodies dining program, with up to 20% off your bill at 30 premium restaurants.

- Relax at over 1,200 lounges in 400 cities around the globe with Priority Pass. Receive unlimited access to any local Bidvest Premier Lounge.

- Access dedicated concierge services, including 24/7 travel services.

SAA Voyager Gold Credit Card

Rates & fees

- R700p/an annual service fee.

- R150 replacement card fee.

- Interest rate 22.25%

- A credit facility fee of R27 a month.

- Zero charges on card swipes.

Requirements

- Monthly income required R6,600 p/m

- Age must be 18 years or older

- Valid South African ID book or Smart card, proof of residence, and the latest proof of income for three consecutive months

Features and Benefits

- Get up to 55 days interest-free on qualifying transactions

- Minimum repayment of 5% on outstanding balances.

- Automatic basic travel insurance up to R3,000,000, with the option to top up at a 10% discounted rate.

- Automatic enrolment to the Voyager Rewards program

SAA Voyager Premium Credit Card

Requirements

- Monthly income required R25,000p/m

- Age must be 18 years or older

- Valid South African ID book or Smart card, proof of residence, and the latest proof of income for three consecutive months

Features and Benefits

- Get up to 55 days interest-free on qualifying transactions

- Multiple ways to earn Bonus Voyager Miles

- Change your credit limit on request.

- Automatic basic travel insurance up to R6,000,000, with the option to top up at a 20% discounted rate.

- Minimum repayment of 5% on outstanding balances.

How to apply for a credit card in Nedbank

To apply for a Nedbank credit card, you have first to check the eligibility criteria, whether you are a salaried or self-employed individual. The bank provides several credit cards based on the eligibility criteria of the person who has applied for the cards. Several factors determine the eligibility of a candidate:

1- Age: To apply for a credit card, the applicant’s minimum age should be at least 18 years. The maximum age for the applicant to apply for a Nedbank credit card is 60 years.

2- Credit Score: The credit score plays a crucial role in deciding whether an applicant is eligible for a credit card or not. The credit score of a credit card applicant must be decent enough to get a Nedbank card.

3- Income: A person with a regular income can apply for a card.

4- Documentation: Different documents such as valid proof of identity, address, and income are required to apply for a Nedbank credit card.

5- Read our previously published article on Nedbank Credit Card Interest Rates.

Here are some steps to applying for a credit card at Nedbank

- Visit the official website of Nedbank, www.nedbank.co.za.

- Choose the best Nedbank card according to your needs.

- Now, select a Credit Card of choice and click ‘Apply Now’.

- Fill in the form and verify your mobile number.

- Tap on the next step and follow the online instructions.

- Once you are done with submitting the form, a representative from the bank will contact you. If you’re eligible for the credit card, your form will be processed further and you’ll receive the card. Read our previously published article on checking Nedbank credit card application status.

Security: Stop or block your card at any time using Online Banking or call Nedbank credit card contact number 0800 110 929.

Frequently Asked Questions

Open the Nedbank app if you’re using it, then tap on the card. Select the relevant card and proceed to ‘Card transaction limits.’ Slide to adjust your local ATM withdrawal limit or point-of-sale daily limit, and finally, tap ‘Save’ to confirm the changes.

Up to 55 days interest-free.

It is accepted globally, and you can load up to eight international currencies with locked-in exchange rates.

On the Money app

Log in with your Nedbank ID, app PIN, or fingerprint.

Go to Cards.

Choose the credit card for which you want to see the balance.

See the balance of your card.

It can take about 2 working days for the card to be delivered in the method you have chosen (for example personal delivery or collection at the nearest Nedbank branch).

When transferring money to or from your bank account, your routing number and account number are both integral in making sure the money is deposited to or withdrawn from the correct account.

Editorial Note: The information presented in this article is not provided by Nedbank. The article has been created for educational purposes and is intended to be helpful for customers of the Bank. It should be emphasized that the content is not endorsed or validated by the Bank, and readers should refer to the official website for accurate and up-to-date information about the bank’s products and services.

Author

Hello friends, my name is RK Singh, and I am an engineer. But by profession, I am a blogger. My main goal in starting this blog is to solve the difficulties people face in using online banking, bank branch codes, debit cards, and credit cards. I am not affiliated with any bank or company. I try my best to give the correct information to the people so that they can achieve their goals in the right way.

For More Information, Please Follow Me On Social Media.