So, in this article we are going to discuss Axos bank’s routing number. Axos Bank is a bank that’s been providing services to their clients since 2000 digitally. In spite of the fact that it has no offline branches of the bank, it acts the same as other traditional banks and offers its customers the service to execute wire transfers that need a routing number. Let’s have a detailed look on the topic:

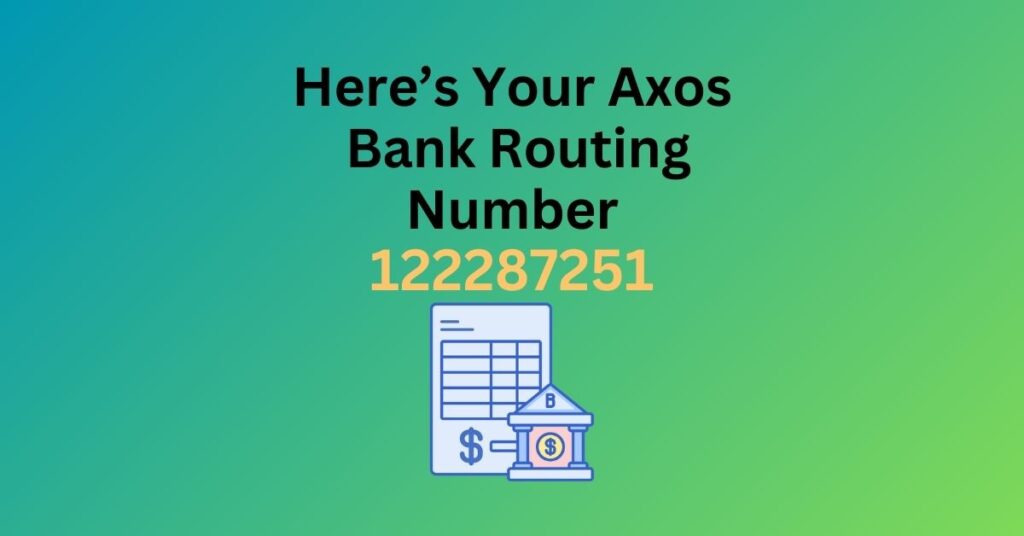

What is the Axos Bank Routing Number

You’ll need to provide a routing number, also known as a transit number, when issuing wire transfers. Here’s the info on Axos Bank Routing Number: 122287251

Because it’s an online bank without branch locations in multiple states, Axos only has one routing number you need to worry about. Don’t miss out! Check our previously published article on Your Webster Bank Routing Number.

What Is a Routing Number?

A routing number consists of 9-digit code that banks use to recognise each other during wire transfers securely. Routing numbers are also known as ABA numbers, short for American Bankers Association. The American Bankers Association had discovered routing numbers more than a century ago. At first, they were only used to recognise the last processing point of checks but eventually expanded to cover a number of things like online payments.

Can Banks Have Multiple Routing Numbers?

Yes, banks can have multiple routing numbers. Usually bigger banks have many routing numbers. Banks like Wells Fargo and Citibank, have many routing numbers for different states and each routing number is different from each other.

How Do You Find a Routing Number on a Check?

Your routing number is present on the corner of the lower -left of your check issued by the bank followed by your account number. Remember that a routing number is always nine digits and account numbers are between 10 and 12 digits.

How to find your routing number online

Here are some of the ways to find your number online:

- On the website – We can search by entering the bank name and routing number for checking listed routing numbers for some of the major banks in the US.

- Online banking – You can see your bank routing number by simply opening your respective bank online banking

- Check or statement – You can see the routing number on the check or bank statement issued by your respective bank.

What Is the Routing Number for International Transfers?

The function of SWIFT codes and routing is the same but there is one difference between them. SWIFT codes used in international transactions and routing numbers used in domestic transactions. Here are the Axos Bank SWIFT code: PCBBUS66

To complete a departing wire transfer with Axos bank, you have to fill out a wire transfer form, which you can find easily on its website. Wire cut-off times are 1 p.m. Pacific Time for transferring money within the country and 12 noon PT for international transfers. Have you seen it yet? Check our previously published article on Umpqua Bank Routing Number.

ACH vs Wire transfers

Confused about ACH transfers and wire transfers? Both methods electronically move money, but they differ in speed and cost.

ACH stands for Automated Clearing House transfers, which enables you to send a check digitally. They take some working days to fulfill as they go via a central network for the verification purpose. The upside? They’re generally free or very low-cost. Perfect for regular bill payments or direct deposits.

Wire transfers, on the other hand, are speedier. They dart directly between banks, frequently on the same working day, sometimes even immediately. But for this privilege, you’ll pay a fee, typically ranging from $25 to $50. So, wire transfers are ideal for urgent transactions or international transfers that ACH can’t handle.

Difference between – Routing numbers, SWIFT codes, BIC and IBANs

You will require some basic information to send or get a wire transfer – either within the country or internationally.

Routing numbers help identify banks when processing domestic ACH payments or wire transfers. But only in the United States. You don’t need one to make a payment to your friend in France, for example.

SWIFT codes, just like routing numbers, used to recognize banks and financial institutions. This time for international payments. They’re sometimes known as BIC codes (Bank Identification Codes)

IBANs stands for international bank account numbers ,their work is to identify bank accounts of individual persons. They’re issued by many banks in Europe, but banks elsewhere in the world are starting to adopt them as well.

Frequently Asked Questions

To start an outbound wire transfer with Axos Bank, first you have to do a wire transfer form that can be found on its official website. Ensure compliance with specified cut-off times for both domestic and international transfers.

Yes, Axos Bank povide their customers support services for any query they have related to banking and they solve them and guide you with your problem. You can contact the Axos Bank’s customer service through phone, email, or by the live chat service available on its website and online Banking app.

Conclusion

In conclusion, we can say that every bank in the U.S has its own routing number that helps them to identify the bank name during any transaction. Moreover ,larger banks have various routing number according to the state and they are different from one another. Routing number enables a user to transfer money within the country. To transfer internationally you have to use SWIFT codes . Check out: How To Open a BB&T Account?